There’s been much reported in the news lately about Amazon—from where the tech giant will open its next headquarters to its impact on offline sales during the holiday’s, Amazon is top of mind lately. And whether it’s correlated or not, their acquisition of Whole Foods in August has kicked off a frenzy of media stories. Fast forward to today, and here’s what we know:

- Amazon is ramping up its presence in Whole Foods. Looking to purchase an Echo in store? The tech giant is pushing their products in-store.

- Whole Foods has been notorious for heftier prices, but Amazon’s acquisition has significantly slashed the price of its goods. Even this past Wednesday, Whole Foods announced further discounted prices for Prime Members.

But what do we know about how the above has impacted Whole Foods and its audiences’ behaviors?

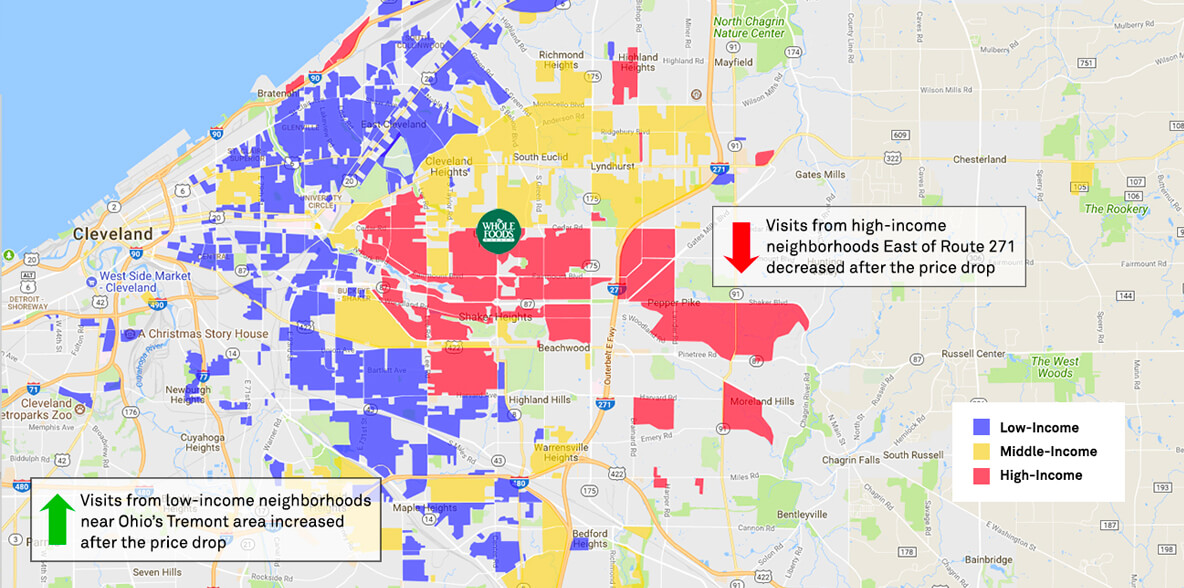

Using GroundTruth’s Neighborhoods product, we performed an analysis on over 400 Whole Foods’ locations to see how visitation affinity to the grocery chain has shifted in demographics and in surrounding neighborhoods. And what we found, proves that Whole Foods is now becoming more accessible to people from various backgrounds and income levels:

- After the price change, visitation from customers coming from high-income neighborhoods decreased 3%, while visitation from customers coming from middle-income neighborhoods increased 3%.

- Whole Foods locations in high-income communities saw the biggest increase in foot traffic from customers coming from middle and low-income neighborhoods, making these locations more accessible for more people.

- The Northeast and West saw the biggest shift in foot traffic, while the Midwest saw the least impact, mostly due to the varying number of Whole Foods locations in each region.

Take the example below from one Whole Foods we analyzed in University Heights, Ohio. The visualization represents the top 30% of neighborhoods who visited the Whole Foods one month before and one month after Amazon dropped its prices. You can see a significant increase in both low and medium income neighborhoods in the ‘after’ visualization.

Toggle from left to right to see the changes in visitation

What can other brands learn from this?

With the retail marketing changing constantly, an analysis like this can help marketers understand how quickly and even how dramatically customer behavior can change following business news. In the Amazon example, we expect to see Whole Foods continue to become more accessible to an audience it once did not appeal to, a strategy that could be hugely beneficial in the new year. And this can prove to be a great lesson for other brands, especially brick-and-mortar ones, who are fighting to remain relevant and competitive in 2018. How can location data help you understand more about your consumer’s journey offline? Reach out to GroundTruth for the answer.