Due to the societal disruption caused by the COVID-19 pandemic, the Internal Revenue Service announced it was extending the tax payment deadline from April 15 to July 15. If you’re in the financial services sector, or have clients who are, there are still many important ways to reach your consumers during these uncertain times. Consumer behavior is changing, and that has implications for how they discover and work with your brand.

This guide looks at current consumer trends relating to tax filing and how small businesses, brands, and agencies can use location marketing to edge out the competition and become the obvious choice for their target market.

Trends in Tax Filing – What’s Changed?

The tax filing deadline has been the same for more than 60 years, so it’s hardly a surprise. What IS a surprise is that fewer people make that deadline each year, which means increased demand for filing date extensions.

According to Forbes, during the first week of this year’s tax season (January 27-April 15), around 15,000 people filed their taxes. That’s down on the 16,000 people who filed during the same period the previous year, and even lower than the 18,000 people who filed the year before that.

There are a few reasons for this trend. The National Taxpayers Union Foundation describes the US tax system as “complex, inefficient, and onerous”. The result is more delays to filing while people check out the latest information on the IRS website. Visits to that site increased by 8.6% in 2019 over the previous year, according to Accounting Today.

Second, people with brokerage accounts may file late because of a cumbersome review process that often results in amended 1099s. Many figure it’s better to wait for the amendment rather than file twice.

And third, e-filing is also on the rise. In 2019, there was a 4.2 per cent increase over the previous year for personal returns, while returns by tax professionals stayed steady.

What Location Data Reveals About Taxpayers

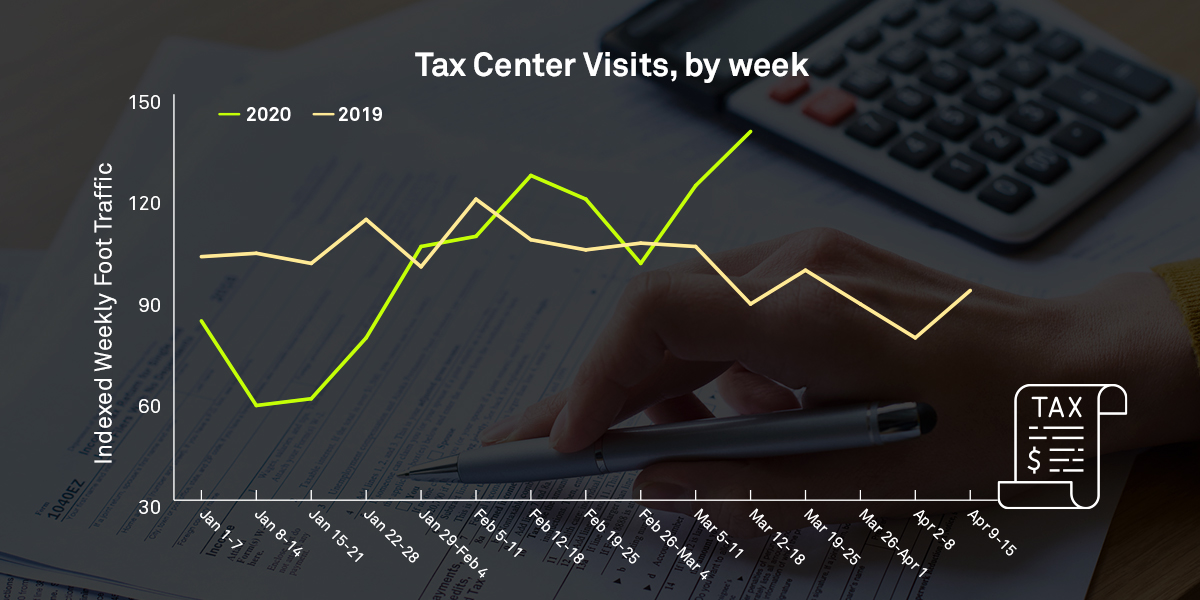

GroundTruth’s foot traffic and visitation data for popular tax centers like H&R Block and Liberty Tax Services supports these findings. People started filing taxes later in 2020 than in 2019. Foot traffic to tax centers was 39% above average and just started to peak around the middle of March.

Foot traffic data to H&R Block, which has strong visitation, shows that the tax center gets more visits after work and on weekends. This suggests that consumers value working with companies whose hours are flexible enough to fit into their daily schedules.

There’s another notable trend. Consumers who file on location as opposed to e-filing have a strong affinity to big box shopping outlets. Brand recognition may play a part in making them feel more comfortable with these brands. In addition, they can enjoy other benefits of large retail stores, like the convenience of doing everything in one place.

All this means that there’s a challenge for financial brands wishing to increase their market share. That’s because getting your taxes done is not like grocery shopping, where there are multiple opportunities to influence customer behavior. Tax filing is an annual event, which means that once consumers decide where they’ll file taxes one year, they’ll likely return to that same place the following year.

However, that doesn’t mean that smaller businesses and brands should give up.

3 Ways to Extend Your Reach With GroundTruth

If you’re looking to extend your reach as a financial services brand or agency with clients in that niche, there are several ways to use GroundTruth’s location marketing expertise to assist with advertising tax services.

1. Target Competition With Conquesting

One tactic to market your tax services is to use conquesting to target and win your competitors’ customers. You can combine location data with behavior insights to identify those who could become your customers, and then retarget them with customized promotions.

2. Get Insight From Foot Traffic Data

GroundTruth’s foot traffic data is a potent source of insight. You can learn who’s visiting what locations when, and get in-depth information on audience demographics and more. That can help you design the right creative to showcase benefits like weekend and after-hours opening to potential customers.

3. Market Your Tax Services to a Custom Audience

Since people who file with the best known financial services brands have an affinity with big box brands, you can use this information to create a custom audience of big box shoppers, using language that targets that audience specifically. An example of this is: “File your taxes today; it’s as easy as shopping at Target”.

By integrating location insights into your tax season marketing campaigns, financial services brands can successfully win more customers. Learn how GroundTruth’s self-serve advertising platform can help you create a location marketing strategy.